Taiwan's Progressive Approach to Cryptocurrency: Balancing Innovation with Regulatory Oversight

How Taiwan fosters secure, innovative crypto growth with stablecoin and regulatory measures.

Cryptocurrency investments have gained popularity, with some companies assisting clients in navigating the space, including cryptocurrency banks offering digital assets as financial products.

This popularity can be determined by the daily trading volume exceeding $100 million in one of Taiwan’s biggest exchanges, MaiCoin. Quantrend Technology, a Taiwanese quantitative trading firm, has achieved an annual trading volume surpassing NT$9 trillion (approximately US$300 billion), ranking it among the top ten global cryptocurrency market makers.

With cryptocurrency becoming more mainstream, it raises concerns among regulators due to the nature of crypto having a “wild west” nature where exploits and scams emerge at a rapid rate.

Unethical companies exploit cryptocurrency through methods like ICO fundraising, arbitrage schemes, and fraudulent "mining profit" schemes targeting average consumers.

Government Response

Under Article 29 of the Banking Act, non-bank entities are prohibited from "accepting deposits" and performing activities typically reserved for banks. Violators can face penalties of up to 10 years in prison under Article 125 if they attract public capital by promising returns above the principal amount.

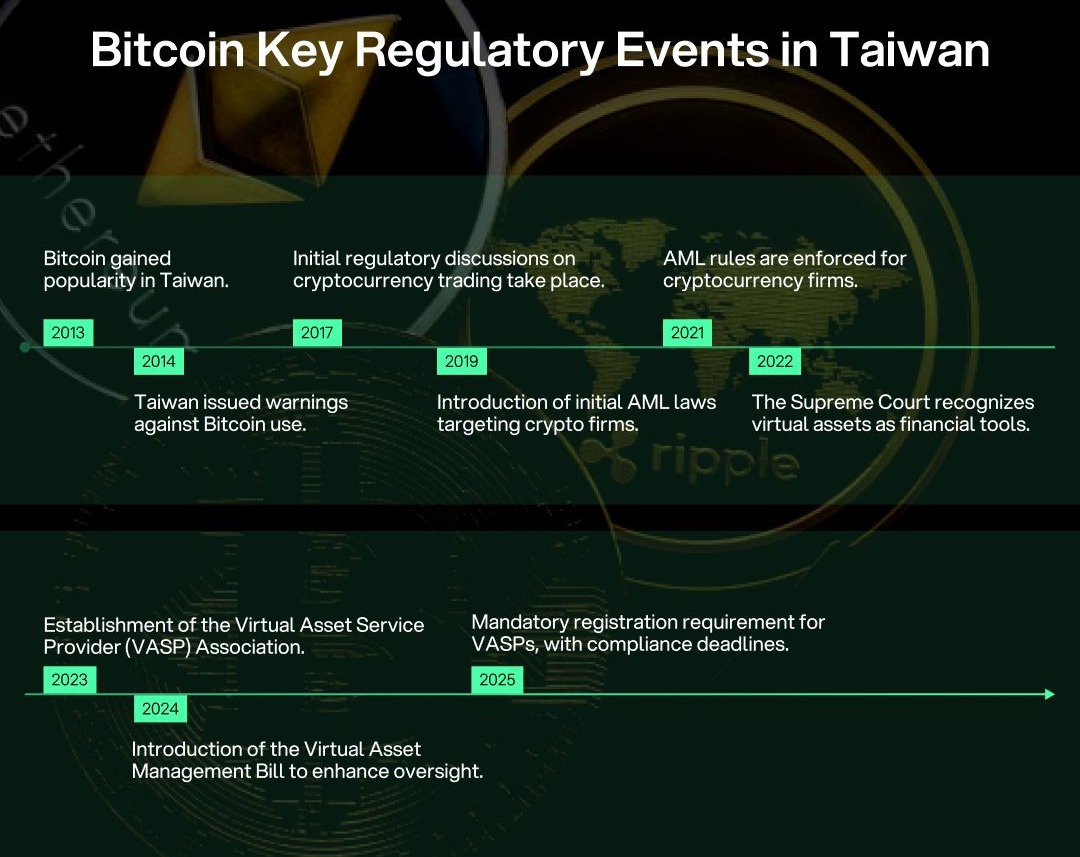

Taiwan courts initially ruled that digital assets like Bitcoin did not qualify as "deposits or capital" under the Banking Act. However, recent Supreme Court decisions reflect a shift in interpretation, viewing virtual assets as financial tools with market impact and accumulation potential similar to traditional currency, suggesting they may be subject to similar regulatory standards.

Some of the Taiwanese regulatory bodies overseeing cryptocurrency in Taiwan includes:

1. The Financial Supervisory Commission (FSC)

Taiwan's main financial regulator, responsible for enforcing anti-money laundering (AML) compliance among crypto firms and guiding self-regulation through the new Virtual Asset Service Provider (VASP) Association.

2. The Taiwan Virtual Asset Service Provider Association (VASP)

Recently established under FSC guidance, this association includes 24 crypto firms working to set industry standards and classifications that align with government goals for a secure and regulated crypto space.

3. The Ministry of Justice (MOJ)

Supports AML efforts in the crypto sector by working with the FSC to enforce compliance for local and foreign firms. Recent MOJ proposals aim to introduce stricter AML requirements and penalties for non-compliance.

4. The Central Bank of Taiwan

Although not a direct regulator of crypto, the Central Bank is developing a central bank digital currency (CBDC) and exploring tokenization, which may impact Taiwan’s digital currency ecosystem.

Stablecoin Initiatives

Taiwan’s Central Bank is advancing its digital currency work, recently completing a feasibility study for a wholesale CBDC and planning further pilots for a retail, or “universal,” CBDC.

Deputy Governor Chu Mei-lie highlighted tokenization as a major goal, with the CBDC positioned to anchor tokenized deposits, stablecoins, and serve as an extra payment option in a tokenized world.

Key Developments:

Universal CBDC Capabilities: Wallet creation, exchange, transfers, shopping, and digital coupons have been tested with five commercial banks.

Scalability: The CBDC platform currently supports 20,000 transactions per second, covering Taiwan’s 23 million residents, with plans to increase capacity.

Offline Functionality: The Central Bank is researching options for offline CBDC use.

Global Integration: Ongoing collaborations with BIS and Swift aim to enhance Taiwan’s role in the global digital finance ecosystem.

Taiwan’s CBDC initiative reflects a commitment to secure, modern digital finance that supports tokenized assets, expands financial inclusion, and streamlines cross-border payments.

In the private sector, Taiwan’s largest crypto exchange, MaiCoin, is preparing to launch a New Taiwan Dollar-backed stablecoin (TWDC) at a 1:1 ratio with the NTD. Led by Leo Seewald, former BlackRock Taiwan head and director at MaiCoin, this initiative aims to foster a stable, regulated digital currency ecosystem in Taiwan.

Seewald views stablecoins as key to bridging traditional finance with the future of digital assets. By ensuring TWDC’s stability and alignment with Taiwan’s regulatory framework, MaiCoin aims to create a trusted platform for crypto transactions and investment.

MaiCoin’s Strategy:

Focus on Stability: TWDC will be conservatively managed to ensure liquidity and minimize risk, distinguishing it from more volatile crypto assets.

Collaboration: MaiCoin is engaging with local and international partners including payment platforms, financial institutions, and tech companies to support TWDC’s adoption in Taiwan and beyond.

Regulatory Engagement: Taiwan’s policymakers are actively engaging with MaiCoin, emphasizing collaboration for a safe and transparent crypto ecosystem.

MaiCoin’s stablecoin initiative represents a significant step in Taiwan’s evolving crypto landscape, aligning with broader national efforts to integrate stable, secure digital assets into everyday financial activities.

Why Local Currency Stablecoin?

XREX, a Taiwan-based blockchain financial institution licensed by the Monetary Authority of Singapore, is at the forefront of stablecoin adoption in Asia. As a co-organizer of the Stablecoin Summit 2024, XREX promotes collaboration between stablecoin issuers, DeFi protocols, and traditional financial institutions to:

Drive efficient cross-border payments

Enhance financial inclusion, particularly in emerging markets

Benefits of a Local Currency Stablecoin

CEO Wayne Huang emphasizes the importance of regulatory-compliant stablecoins, which aligns with XREX’s vision of a secure, regulated blockchain ecosystem. An NTD-backed stablecoin would offer key benefits for Taiwan:

Reduced Reliance on Foreign Currencies: Enabling digital transactions without converting to foreign currencies.

Lower Transaction Fees: Providing more affordable cross-border payment options.

Simplified Trade: Streamlining transactions for businesses and individuals alike.

Enhanced Stability: Giving Taiwan’s citizens and businesses a reliable digital currency option.

Through these initiatives, XREX aims to position Taiwan as a leader in blockchain finance, using stablecoins to support local economic growth and innovation.

Security and Fraud

Taiwan has recently intensified efforts to combat crypto-related crime, highlighted by its largest cryptocurrency money laundering case to date, involving 324.2 million USDT.

The main suspect, surnamed Chiu, along with three accomplices, allegedly directed victims to transfer funds to fraudulent accounts. These funds were converted into cryptocurrency, transferred to overseas exchanges, and cashed out. Confiscated assets included luxury vehicles, high-end watches, work phones, and narcotics.

In response to cases like this, Taiwan’s Legislative Yuan introduced the Virtual Asset Management Bill, aiming to enhance consumer protection and regulatory oversight. Key measures in the bill include:

Segregating Customer Funds: VASPs must separate customer assets from company reserves.

Internal Controls: Mandated audits and control systems to reduce fraud risks.

Licensing: VASPs without a license may face fines between 2–20 million TWD ($60,000–$600,000), with a six-month compliance period for existing firms.

This legislation reflects Taiwan’s commitment to a secure and compliant cryptocurrency industry, focusing on consumer safeguards to deter fraud.

Further exposing vulnerabilities within crypto, Taiwan’s "Creative Private Room" scandal, often compared to South Korea's Nth Room, revealed severe abuses in the digital space. This platform distributed illegal videos of underage exploitation, using blockchain wallets to handle payments.

XREX, a blockchain financial institution, conducted an in-depth investigation into the money flow linked to “Creative Private Room,” tracking on-chain transactions from four wallets associated with the platform. XREX’s report revealed the payment network behind this operation, pinpointing key actors and potential beneficiaries.

The XREX report highlights the need for strengthened digital asset regulations in Taiwan, raising important questions:

User Identification: How can wallets used in criminal activities be connected to real identities?

Transaction Tracking: What tools can trace illicit funds and reveal the structure behind criminal operations?

These cases emphasize the urgency of Taiwan’s regulatory developments, including stricter AML standards, VASP registration, and proposed digital asset legislation. With these measures, Taiwan is building a more transparent crypto ecosystem capable of identifying and preventing illicit activities.

Conclusion

Taiwan’s approach to cryptocurrency balances innovation with strong consumer protection and security measures. By establishing a robust regulatory framework, Taiwan aims to create a safe, transparent ecosystem where digital assets can thrive responsibly.

From stablecoin initiatives to the XREX investigations and new regulations, Taiwan’s proactive measures set a regional standard for balancing growth with oversight. Through collaboration and a commitment to security, Taiwan is paving the way for a secure, accessible future in digital finance.