AI Industry Overview

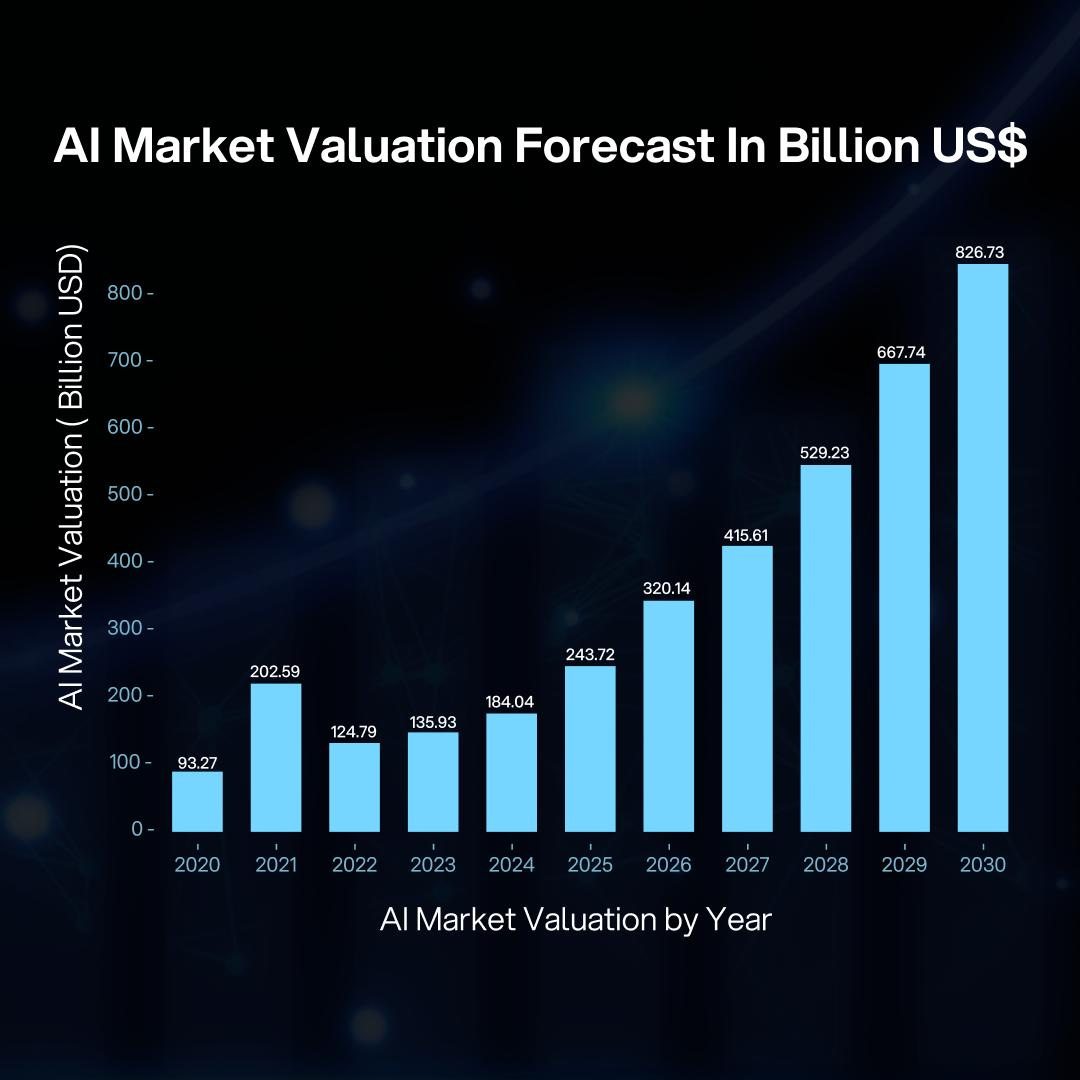

In recent years, the Artificial Intelligence (AI) industry has taken the world by a storm. As of 2024 the global AI market size sits at US$184 billion. This industry has grown by 97% since 2020 where its global market size was at US$93 billion. Analysts are forecasting this industry to reach a market valuation of US$243 billion by 2025 and US$826 billion by 2030. This growth is being led by industry leaders such as:

OpenAI

Nvidia

Meta

Microsoft

Google

The AI industry covers a wide range of sectors and companies working in many different things. OpenAI and Nvidia provide us with a good contrast on how vibrant the AI ecosystem is. OpenAI is an artificial intelligence research company dedicated to advancing artificial general intelligence (AGI). While Nvidia is software and fabless company which designs and supplies graphics processing units (GPUs) which then are used to train the AI models.

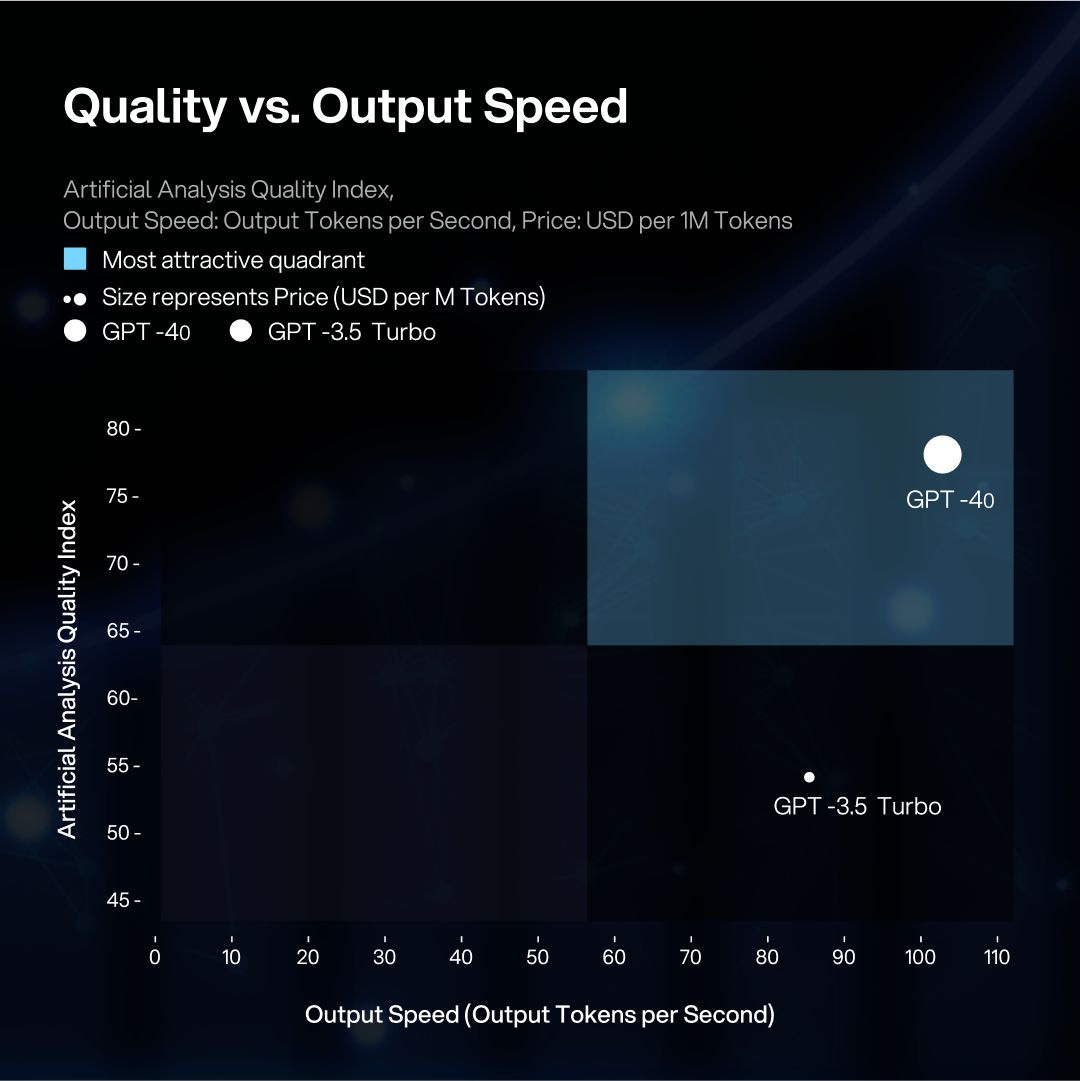

To understand if the industry is inflated it is important to understand the advancement of the industry. A good example would be taking the most popular AI generative model, GPT from OpenAI. Moving forward is the comparison of GPT 3.5 Turbo which was launched in November, 2023 and GPT 4o that was launched earlier this year in May, 2024.

According to the data from Artificial Analysis, an Independent analysis of AI models and API providers, the newer model GPT 4o is significantly better from its prior model GPT 3.5 turbo in providing better quality response and speed. Do keep in mind that its better performance also comes with a higher cost.

Global AI Market

There has been a huge influx of new AI startups appearing everywhere around the globe with most of them utilizing generative AI APIs as the backbone of their services. These are a series of the biggest generative AI startups alongside the amount of investment they managed to raise as of August 28:

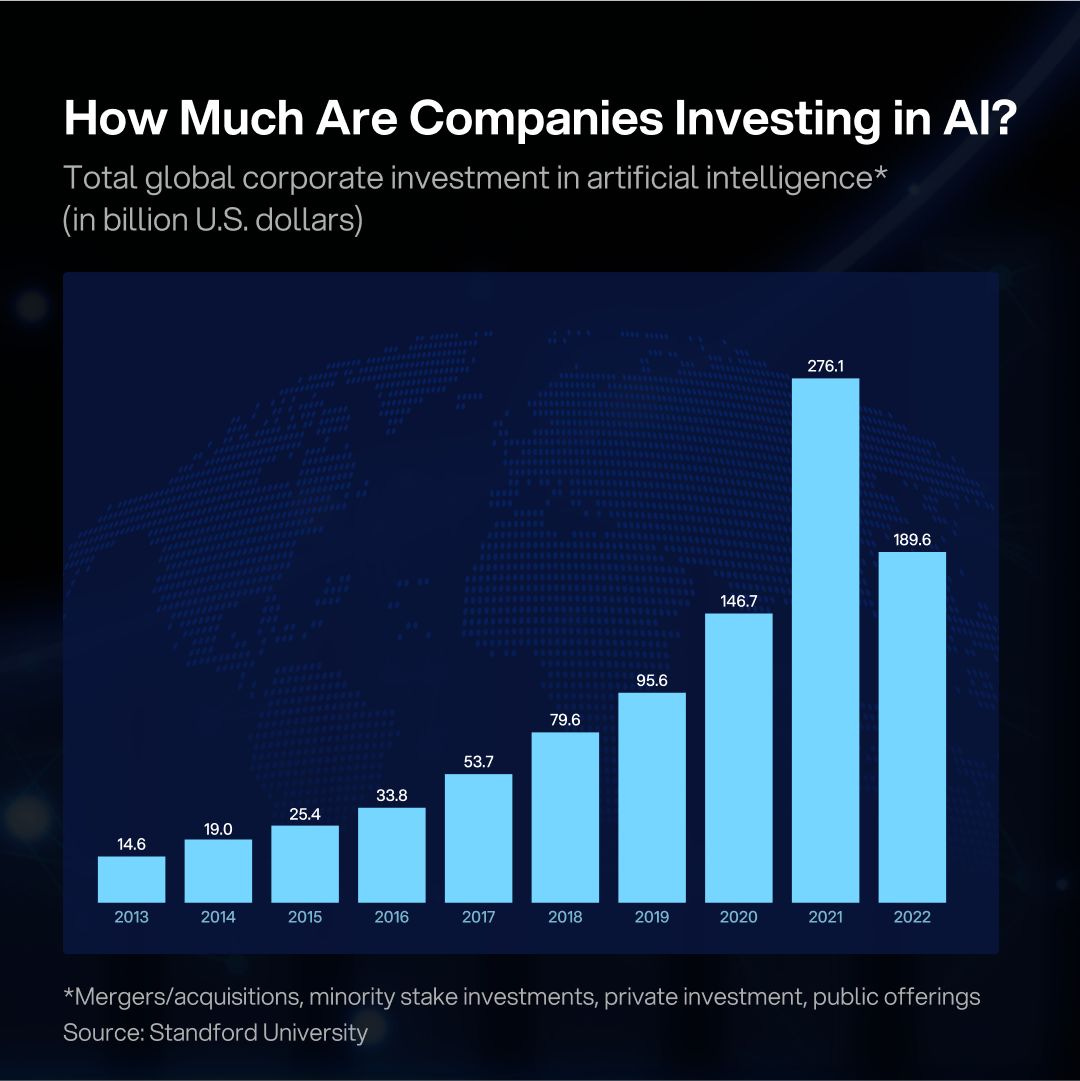

With AI being a relatively new industry, companies are flocking in trying to get into the space early in hopes of getting a huge return in the future. A chart from Stanford University estimates that the sum of assets and acquisitions from minority stakes, private investments, and public offerings reached a total of $934.2 billion from 2013 to 2022. Annual investment has recently peaked at over US$276 which was one year prior to the release of ChatGPT.

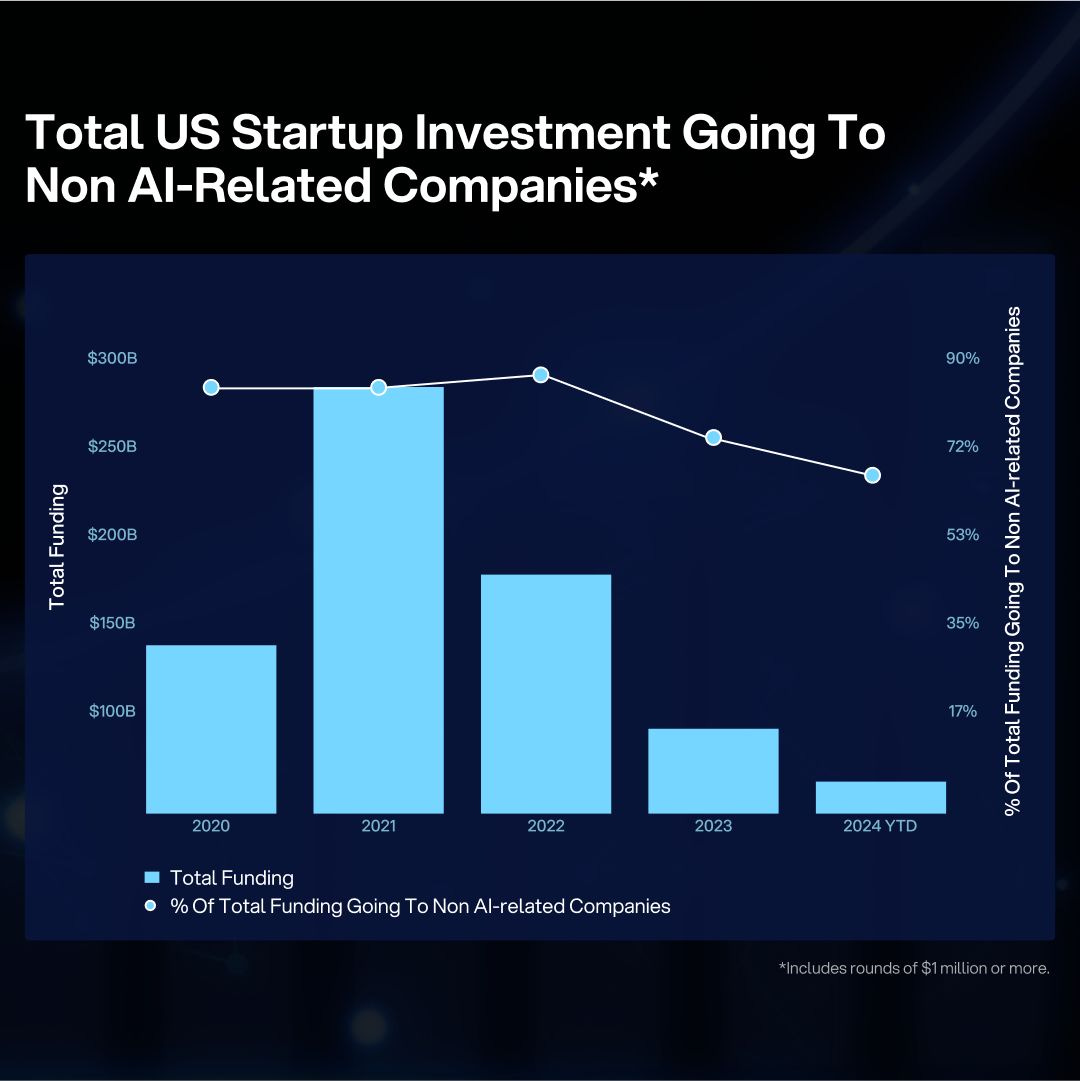

Alongside receiving a huge influx of investment from companies, AI is also disrupting the market of Startup Investments. Data from Crunchbase have shown that investments to non-AI companies have gone down from 85% in 2020 to 65% in 2024. This is an indicator that investors are now focusing more to invest into new AI-related companies.

But not all of these are pure AI companies like the generative AI focused OpenAI and Anthropic which are developing the core technology. Some companies in this category may only be using AI models from generative AI focused companies as a feature that caters to many other industries.

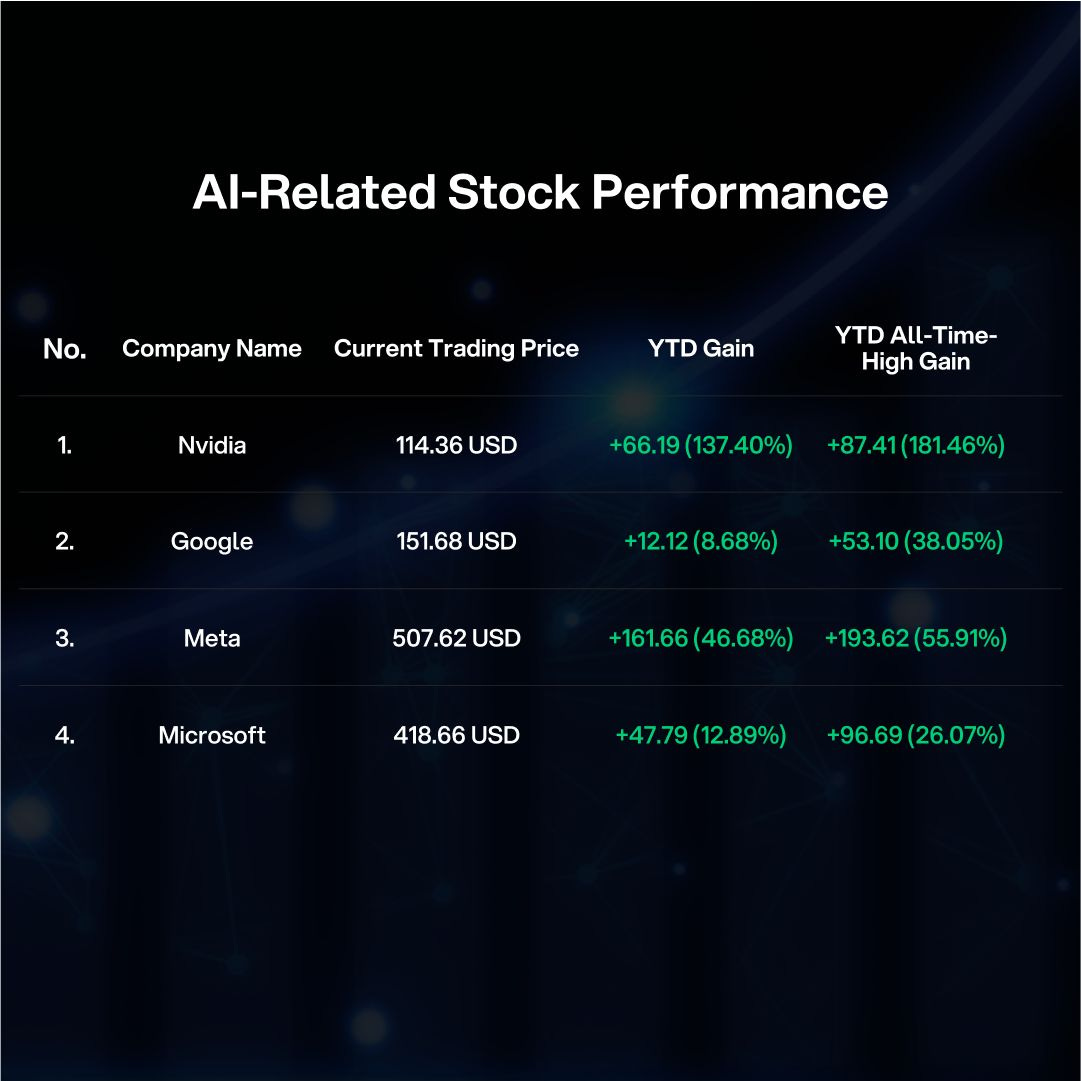

Investor demand and optimism on the AI industry can also be shown in the stock market where some tech companies that are involved with building and advancing the AI industry’s infrastructure are experiencing a notable increase in value.

The following table is formatted in stock name, current trading price, and YTD percentage gain as of September 11:

Nvidia has been outperforming all the other AI related stocks, this is mainly caused due it being the biggest Graphics Processing Unit (GPU) manufacturer. GPUs are used to train Large Language Models (LLMs) and AI models and with AI driving a 1220% surge in demand for computer power, this increased Nvidia’s revenue and made it play a pivotal role in the AI industry. Resulting to the significant increase of 173% YTD of its stock price.

Taiwan’s AI Market

Overview

Taiwan is currently producing over 90% of the most advanced semiconductors that are used in making GPUs and other necessary infrastructures to train and develop AI. The AI ecosystem in Taiwan is also well-rounded, having a lot of companies and startups integrating AI technology in other industries such as advertising, health care, beauty, and many others.

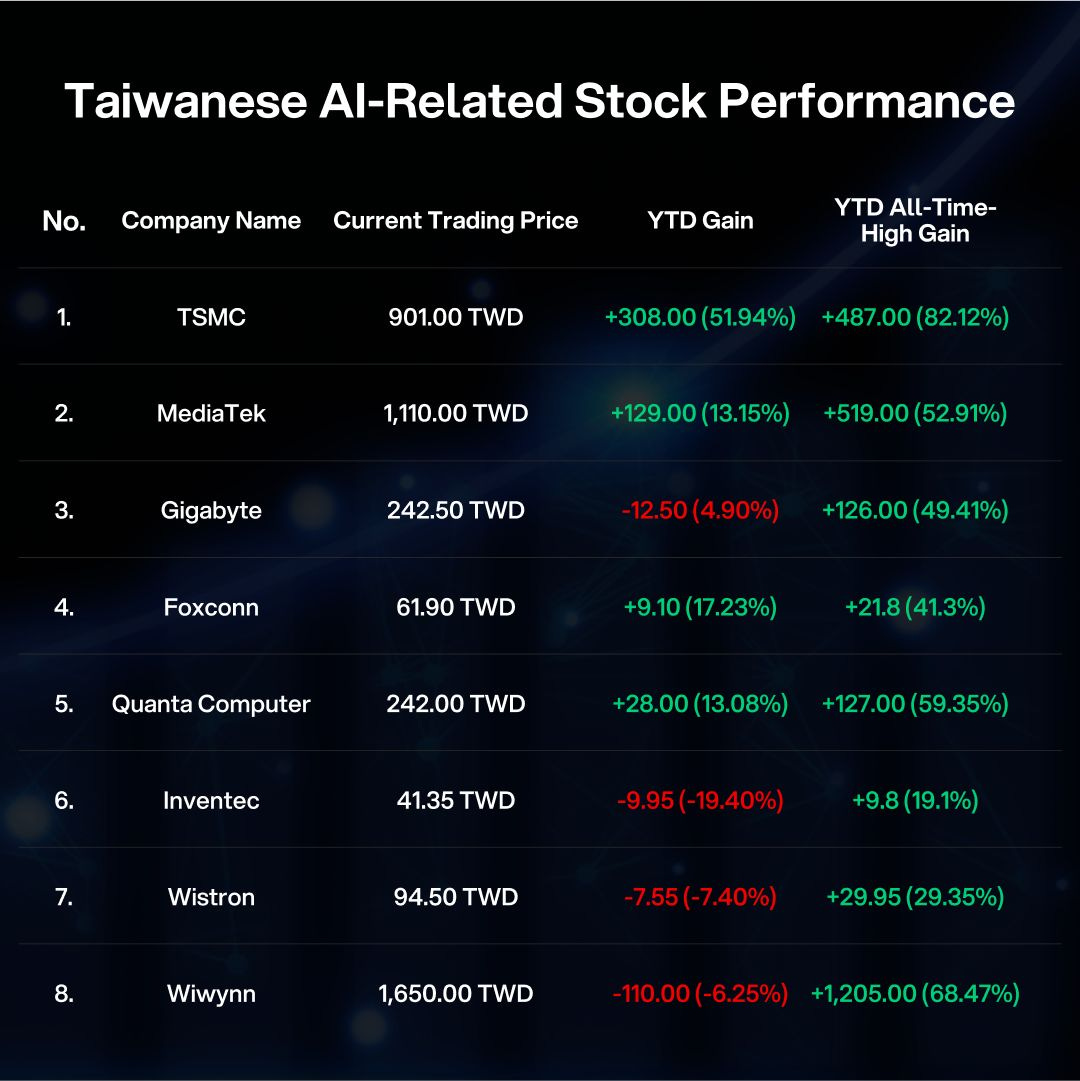

While the AI industry is booming with most of the stocks in the stock market making all time highs this year, some stocks have fallen a significant amount from their all-time-highs with most of them being computer hardware manufacturers.

The following table is formatted in stock name, current trading price, and YTD percentage gain as of September 11:

Companies like Gigabyte and Wiwynn both made significant gains this year with their stock appreciating by 49.41% and 68.47% at their year-to-date all time highs respectively.

Wiwynn’s stock price drop is caused by the significant decline in revenue in the third quarter of 2024, with a 33.7% year-on-year decrease. While the company’s AI server revenue has increased, Wiwynn struggles to compete in the broader market.

Gigabyte’s cause of stock price drop is no different from Wiwynn, their earnings have been lower than expected by investors which was caused by the weakening demand for PC and gaming-related products. As of recently Gigabyte has been putting their efforts to break into the AI industry with them introducing AI infrastructure solutions and high-performance computing systems at COMPUTEX.

Global Influence

Taiwan has a lot of companies that are involved in the local and global AI ecosystem. These companies’ have a notable presence when it comes to the advancement of AI technology. Here are some of the companies alongside with their influence in this industry:

TSMC

Considered to be the best and largest semiconductor manufacturer supplying to tech giants like Nvidia and Apple. TSMC is known for their cutting-edge manufacturing processes.

ASUS

ASUS have positioned their company to have global reach while being a notable player in the AI-driven PC market. They have started making strides in the AI industry through innovations in machine learning.

Foxconn

One of the largest electronics manufacturers while leveraging AI technology to be integrated into factories globally for automation in manufacturing.

Wiwynn

Known for designing and manufacturing cloud-based IT infrastructures such as AI servers where it supports many large-scale AI applications worldwide including data processing and machine learning.

MediaTek

Plays an important role in producing smartphone chips, making AI accessible to millions of consumers worldwide. MediaTek chips integrate AI processing units for tasks such as image recognition and voice interaction.

At COMPUTEX 2024, Nvidia showcased their partnerships with many Taiwanese companies that focus on developing the AI industry. Some of the Taiwanese companies that are involved are:

ASUS

GIGABYTE

Wistron

Wiwynn

Supermicro

Pegatron

QCT (Quanta Cloud Technology)

Nvidia has also recently announced its plans to establish their first AI research and development center in Taiwan which will be supported by the Ministry of Economic Affairs. The center will be focusing to develop AI platforms and serve as an incubation zone for talents in collaboration with local universities.

Government Involvement

In the past, Taiwanese government Executive Yuan has rolled out an “AI Taiwan Action Plan” which discusses the advance tactics the government is going to execute over the year 2018-2021. This plan consists of 5 major components which covers the scope of:

Developing AI talent

Promoting Taiwan’s lead role in AI

Building Taiwan into an AI innovation hub

Liberalizing laws and opening test grounds

Transforming industry with AI

Recently this year on August 24, The Ministry of Digital Affairs announced that it will invest NT$10 billion (US$313 million) in domestic AI startups over the next 10 years. MODA Minister Huang Yen-nun stated that the first seven years will be dedicated to investments and the last three years to divestments.

Besides funding the development of AI, the Taiwanese government has started working on drafts for artificial intelligence law. Back on July 16, The Cabinet-level National Science and Technology Council (NSTC) revealed a draft proposal covering the use and reliability of AI and mitigation of the risks associated with it such as labeling AI generated content.

The government’s efforts of trying to make Taiwan as the leading country in the AI industry are further shown when President Lai Ching Te vows to to turn Taiwan into an “AI island” during Computex Taipei. President Lai pointed out the three fundamental policies that the government would implement:

Ensuring a reliable supply of electricity and providing a diverse form of “green energy”.

Setting up supercomputer infrastructures to ensure the constant development of AI in Taiwan.

Cultivating talents in relevant fields such as information and communication technology, wafer and semiconductor manufacturing, and the AI industry.

President Lai further added the government’s expectations that more than 1 million small and medium-sized companies around the country would apply AI in running their businesses. This implies that the Taiwanese government is very optimistic and supportive of the AI industry.

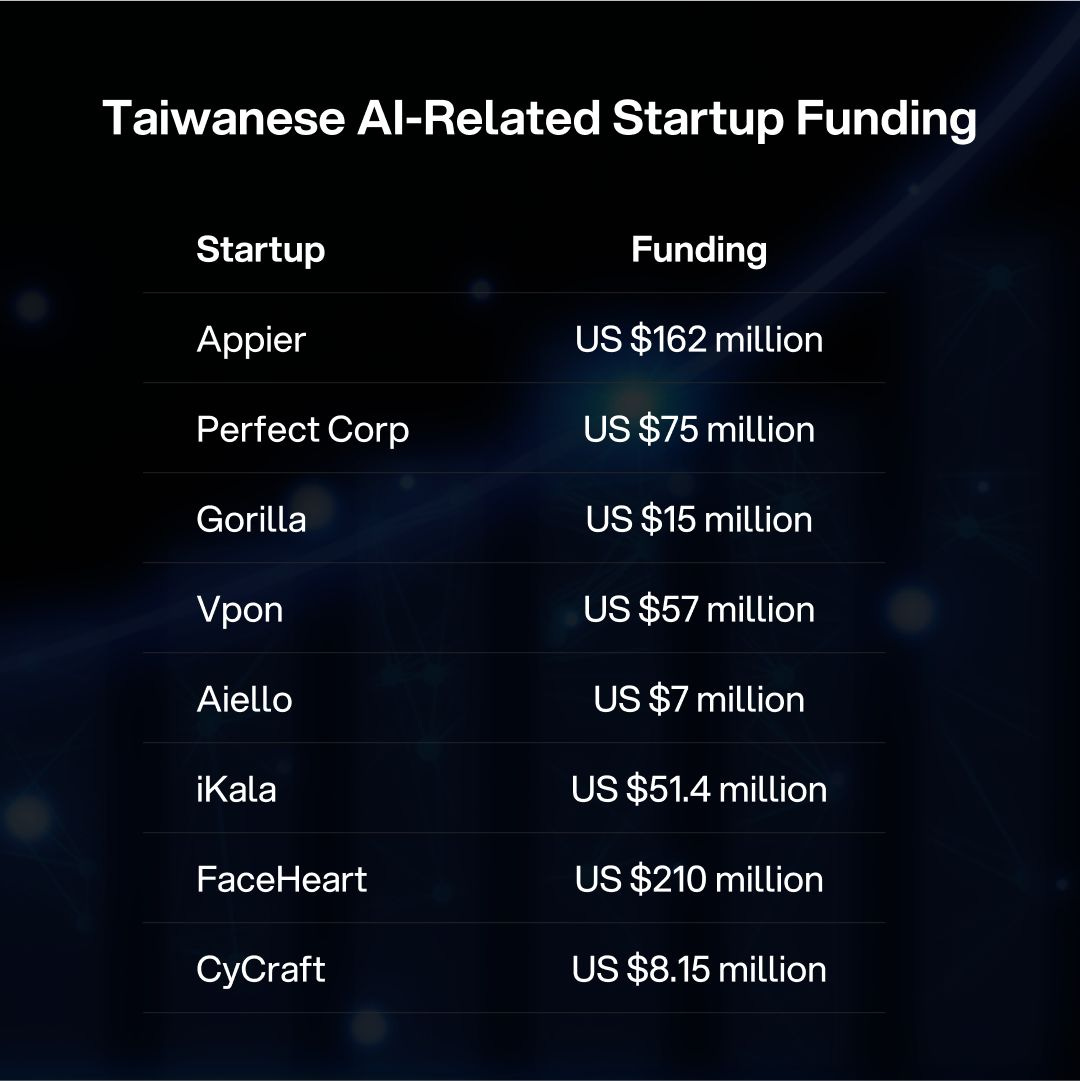

Taiwanese AI Startups

Appier

A cloud-based multi-channel advertising and marketing campaign management solutions provider that uses AI and RTB technology to track user behavior across devices.

Perfect Corp

AI and AR-based virtual makeup application solutions that enable users to virtually try makeup through the application's facial mapping technology.

Gorilla

Offers AI based video data analytics solution that leverages AI to automate stream processing and analyze video data to solve big data related issues.

Vpon

AI powered big data analytics platform for advertising teams that includes technology such as AI creative generator, AI optimization and more.

Aiello

NLP and cloud-powered platform provider to develop voice bots that provide tools to create tailored well-rounded voice bots into a single AI model.

iKala

AI powered influencer marketing platform and cloud management solutions that provide influencer meaningful insights on their social media metrics.

FaceHeart

Heart monitoring application which utilizes AI technology to monitor body vitals such as heart rate, blood pressure, and others.

CyCraft

A platform which offers incident response solutions available through their diverse product lines while also assisting in detecting real time threats.

Challenges

With the large growth that the AI industry is experiencing there are several limiting factors to it such as increased computing power requirement, storage capabilities, and data management. Another point to keep in mind is the cost and profitability of the AI industry. Take OpenAI as an example, it has spent roughly US$7 billion on LLM (Large Language Models) training & inference, additionally OpenAI have spent around US$1.5 billion on staffing. Analyst US$700,000 per day to run ChatGPT through Nvidia’s AI servers. It has been reported that OpenAI’s annualized revenue is US$3.4 billion, making them burning money to keep their operation running.

On the other hand, one of the most famous semiconductor manufacturer companies, TSMC has reported a Q2 revenue of NT$673.51 billion and a net income of NT$247.85 billion resulting in an increase of 40% and 36% year-over-year respectively. According to the data above companies that are building the infrastructure for AI companies are currently more profitable than the AI companies themselves.

Regulations can also be a roadblock, with unclear regulations and consumer privacy being a concern some people remain skeptical about this industry. The AI industry is also not aligned with the carbon regulations with the escalating and localized environmental costs of AI.

A report estimated that with 3.5 million H100 shipments through 2023 and 2024 can consume 13.1 TWh of power annually.

Morgan Stanley is estimating global data center power use to triple from ~15 TWh in 2023 to ~46 TWh in 2024.

Wells Fargo is projecting AI power demand to surge from 8 TWh to 52 TWh, which translates to an increase of 550% by 2026.

AI training is expected to drive power demand at 40 TWh in 2026 and 402 TWh by 2030.

Final Thoughts

Despite the hurdles that the AI industry needs to face, professionals are confident that AI is here to stay. While some people may consider this industry a tech bubble, it is to be expected with an emerging industry.

According to sources, around 70-80% of AI companies have failed. This really shows how cut-throat the industry is, survival of the fittest where only the best companies can emerge on top.

Addressing the concerns on how to make the AI industry sustainable, some suggests:

Sustainable energy source

Maximize byproducts from the AI industry

considering the entire lifecycle of hardware

choosing more energy-efficient algorithms

optimizing the utilization of data centers

With the amount of help that AI has given to professionals it is important to think critically about this industry and pin-point the critical issue to be addressed with hopes of it getting improved and solved in the future.